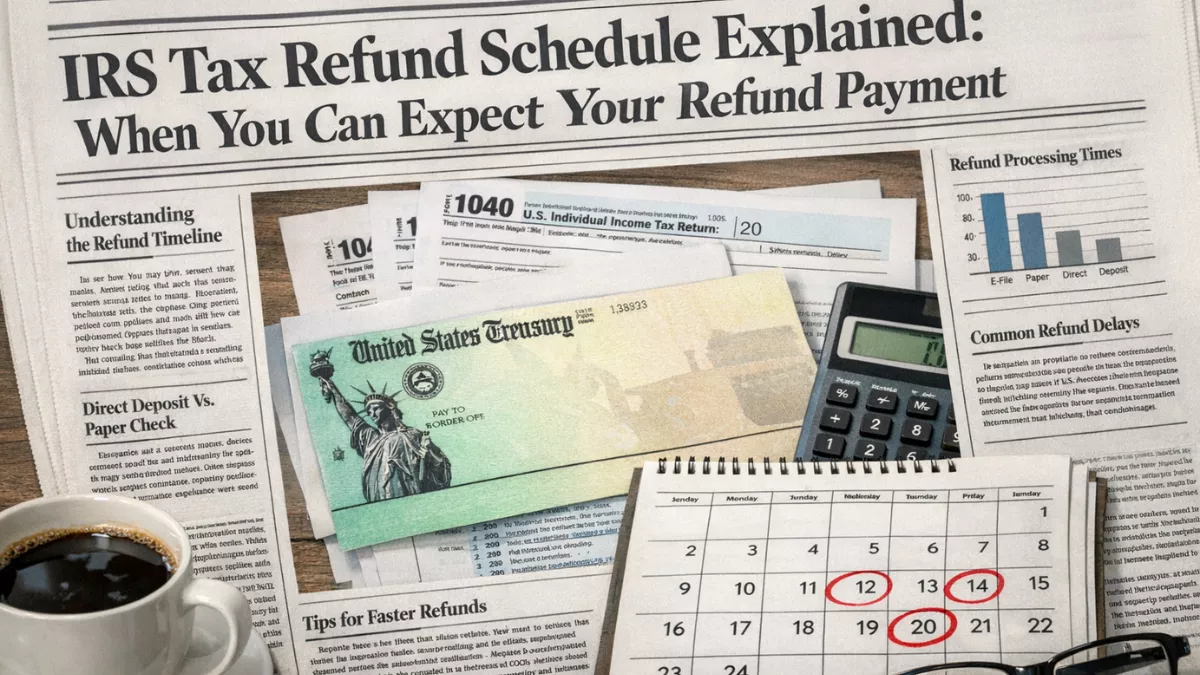

The 2026 tax filing season has now started, and millions of Americans are getting ready to submit their tax returns with one big question in mind: when will their tax refund arrive? For many families, a refund is not just extra cash but an essential part of their financial planning.

It is often used to cover bills, pay off debt, add to savings, or handle everyday expenses. Understanding how the refund process works can help avoid confusion and create more realistic expectations.

How the IRS Refund Process Works

After a tax return is filed, it goes into the Internal Revenue Service processing system. Electronic returns are typically confirmed within 24 hours. Once accepted, the IRS reviews the return to check for mistakes, match income records, and identify any issues such as identity verification or eligibility for certain credits.

For most accurate returns filed electronically with direct deposit selected, refunds are usually sent within about 21 days. However, this timeline is only an estimate and can be different for each taxpayer.

Filing Method and Refund Speed

The method used to file a return has a major impact on how quickly a refund is received. Filing electronically and choosing direct deposit is the fastest option and is preferred by most taxpayers. Paper returns take more time because they must be processed by hand.

If someone files a paper return and requests a refund by mailed check, the wait time can stretch to six weeks or even longer, especially during the busiest weeks of tax season.

February Refund Expectations in 2026

People who file early and meet all requirements often receive their refunds in February. Many early electronic filers may see their refunds in the first half of the month, while others might receive them closer to the end of February.

The key factor is when the IRS officially accepts the return, not simply the date it was submitted. For electronic returns, acceptance usually happens quickly after filing.

Credits and Common Causes of Delays

Refunds that include certain refundable tax credits can take extra time to process. The law requires additional review steps to help prevent fraud, which may delay these refunds until later in February or even beyond.

Other common reasons for delays include errors in personal information, incorrect bank account details, missing tax forms, or requests for identity verification. Double-checking all information before filing can reduce the risk of these delays.

Tracking Your Refund and Final Advice

The IRS offers online tools that allow taxpayers to check the status of their refund. These tools show when the return has been received, approved, and sent. After the refund is issued, banks may take a short time to complete the deposit.

While most refunds are delivered within three weeks, it is wise not to rely on a specific payment date. Filing early, using electronic filing with direct deposit, and making sure all information is correct are still the best ways to receive a refund smoothly in 2026.

Disclaimer: This content is for general information only and should not be considered legal or tax advice. Tax rules, refund timelines, and eligibility requirements may change. For guidance related to your personal situation, review official IRS information or speak with a qualified tax professional.

✨ You May Also Like ✨

IRS Today Announced $2,000 Direct Deposit for All – February 2026 New Payment Schedule & Eligibility Guide

IRS Today Announced $2,000 Direct Deposit for All – February 2026 New Payment Schedule & Eligibility Guide Social Security Payment Update: Millions May Qualify in 2026

Social Security Payment Update: Millions May Qualify in 2026 IRS Confirms Deposits! How Tariff Dividends and Refunds Will Be Processed | 2026 Stimulus Payment Guide

IRS Confirms Deposits! How Tariff Dividends and Refunds Will Be Processed | 2026 Stimulus Payment Guide Social Security 2026 new monthly payment figures : Social Security payment boost for 2026 confirmed

Social Security 2026 new monthly payment figures : Social Security payment boost for 2026 confirmed $2,000 Federal Direct Deposit February 2026: Payment Schedule, Eligibility

$2,000 Federal Direct Deposit February 2026: Payment Schedule, Eligibility