In early February 2026, thousands of people in Washington state saw checks and digital payments arrive in their accounts — a direct result of a $12.5 million class-action settlement with Cash App’s parent company, Block, Inc.

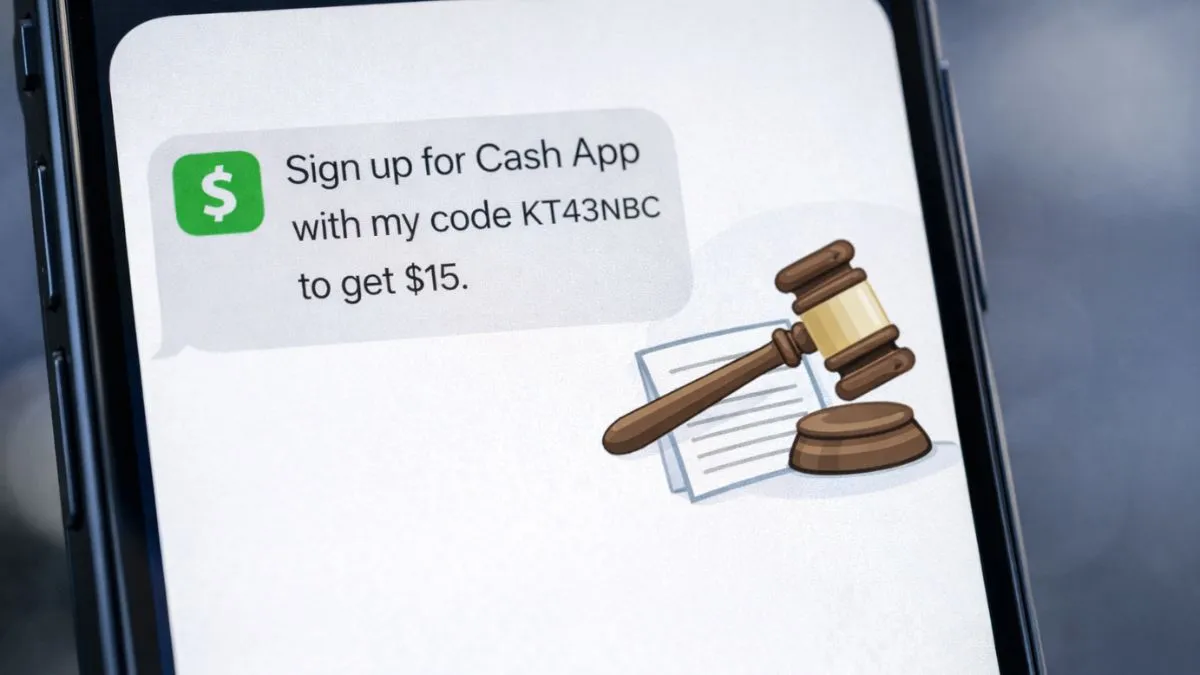

The case centers on allegations that the payment app sent or helped users send unsolicited “Invite Friends” referral text messages without clear consent. Those caught up in the case could receive roughly $88 to $147 per person, and in some instances significantly more, depending on how many valid claims were filed.

Here’s what the settlement is really about, why it matters, and what it means for users now.

How the Settlement Happened: Spam Texts, Consent, and Consumer Law

The lawsuit — filed as Bottoms v. Block Inc. — alleged that Cash App’s “Invite Friends” referral program encouraged users to send pre-written promotional texts to their contacts. Recipients of those messages argued they had not given “clear and affirmative” consent to receive marketing communications, which under Washington state law is required before companies can send commercial text messages.

Under Washington’s Commercial Electronic Mail Act (CEMA) and the Consumer Protection Act, sending unsolicited commercial texts without consent can be unlawful. The plaintiffs claimed that Cash App’s system substantially assisted in sending these messages, making the company liable even if the texts technically came from individual users’ phones. Cash App did not admit wrongdoing in resolving the case but agreed to settle to avoid the risk and cost of further litigation.

Who Was Eligible and What Payments Looked Like

To qualify for a payment:

- You received one of the referral program texts between Nov. 14, 2019 and Aug. 7, 2025.

- You were a resident of Washington state when you got the text.

- You did not clearly opt in to receive such messages.

Once the settlement received final approval in December 2025, notices went out and claim forms had to be submitted by Oct. 27, 2025. Those who filed valid claims were assigned payments, which were distributed beginning in February 2026 via checks or digital options like PayPal or Venmo.

Although early projections estimated payouts between $88 and $147, actual per-person amounts in some reports reached higher figures (for example, roughly $394) because fewer people claimed than originally expected — meaning the pot was divided among a smaller group.

Why This Matters Beyond the Money

At first glance, this kind of settlement might seem like a modest payout for a one-off marketing text — but it points to a broader shift in how courts and regulators are enforcing privacy and anti-spam laws in the digital age. Fintech apps like Cash App collect contact lists and can leverage them for growth, but consumer consent standards are also evolving. What was once seen as “harmless growth” can now trigger legal exposure.

This settlement is also part of a larger context of legal scrutiny in the fintech sector. Cash App settlements and regulatory actions in recent years have touched on issues from data breaches to customer service and fraud protections, with multiple enforcement actions and consumer lawsuits shaping how the company responds to user concerns.

What If You Missed the Deadline?

Because the claims period closed in October 2025, new claims are not being accepted now. News reports and settlement administrators make clear that payments issued in 2026 reflect claims already submitted.

If you think you were eligible but missed the deadline, you generally cannot file a new claim — even if you received one of the messages. That’s typical in class actions once they’re finally approved and distributed.

Final Takeaway: Privacy, Consent, and the Changing Fintech Landscape

Cash App’s $12.5 million settlement and the subsequent payouts are a concrete reminder that technology convenience doesn’t override privacy rights. Sending a referral text might feel innocuous, but the legal threshold for consent — especially in commercial messaging — remains high.

For users, it’s a teachable moment: review your app settings, be cautious about notifications and permissions, and understand how your contact information is used. For companies, this settlement reinforces the cost of sailing too close to the edge of marketing and privacy laws.

Whether you received a payment or just heard the headlines, this case signals a future where consumer protection and tech innovation must find firmer common ground — and where users’ rights in the digital age are increasingly enforceable in court.

✨ You May Also Like ✨

IRS Today Announced $2,000 Direct Deposit for All – February 2026 New Payment Schedule & Eligibility Guide

IRS Today Announced $2,000 Direct Deposit for All – February 2026 New Payment Schedule & Eligibility Guide Social Security Payment Update: Millions May Qualify in 2026

Social Security Payment Update: Millions May Qualify in 2026 IRS Confirms Deposits! How Tariff Dividends and Refunds Will Be Processed | 2026 Stimulus Payment Guide

IRS Confirms Deposits! How Tariff Dividends and Refunds Will Be Processed | 2026 Stimulus Payment Guide Social Security 2026 new monthly payment figures : Social Security payment boost for 2026 confirmed

Social Security 2026 new monthly payment figures : Social Security payment boost for 2026 confirmed IRS Tax Refund Schedule Explained : When You Can Expect Your Refund Payment

IRS Tax Refund Schedule Explained : When You Can Expect Your Refund Payment