Every year, millions of Americans eagerly wait for their tax refunds — a financial boost that helps with bills, savings, or even vacations. With the 2026 tax season underway, understanding when you’ll receive your refund can help you plan ahead.

The IRS has streamlined its refund process, but timing still depends on several factors, including when you file, how you file, and whether you choose direct deposit or a paper check.

When Tax Season Officially Begins

The IRS officially began accepting and processing 2025 tax year returns in late January 2026. Most taxpayers filing electronically with direct deposit can expect refunds within 21 days of the IRS accepting their return.

However, those who claim specific credits such as the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) may see slight delays because the IRS must verify those claims to prevent fraud.

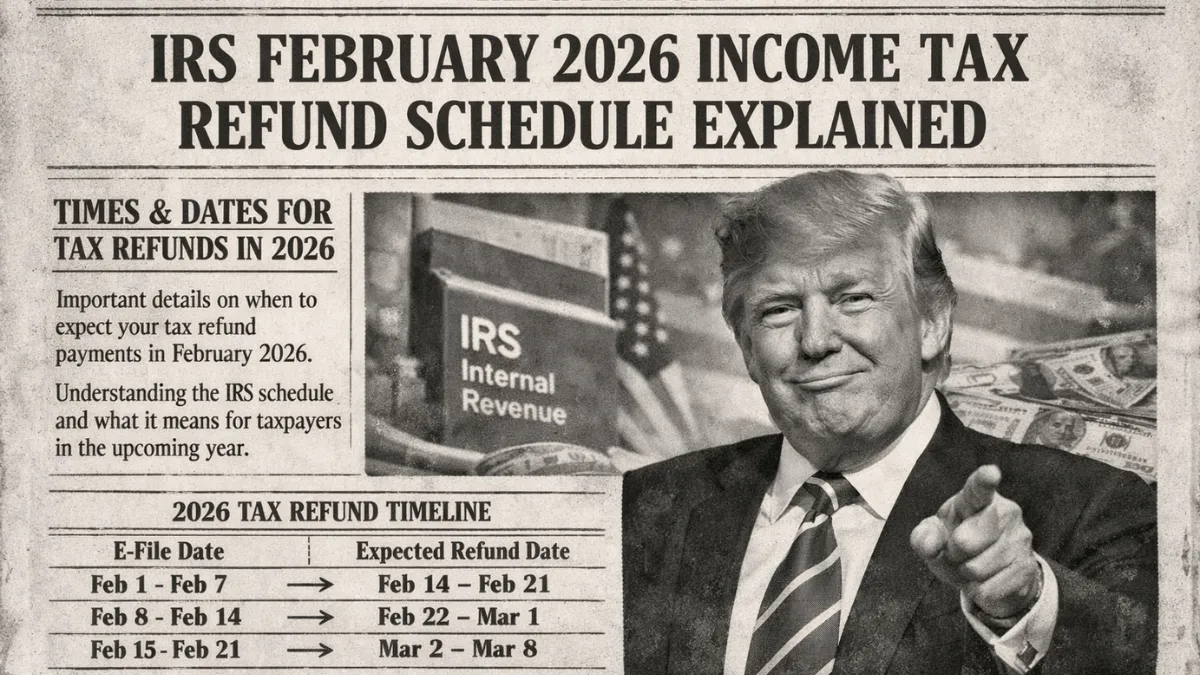

Estimated Refund Schedule for February 2026

Here’s a general guide to when you can expect your refund based on filing and acceptance dates:

| IRS Return Accepted Date | Estimated Direct Deposit Date |

|---|---|

| Jan 27 – Feb 2, 2026 | Feb 14 – Feb 21, 2026 |

| Feb 3 – Feb 9, 2026 | Feb 22 – Feb 28, 2026 |

| Feb 10 – Feb 16, 2026 | Mar 1 – Mar 7, 2026 |

| Feb 17 – Feb 23, 2026 | Mar 8 – Mar 14, 2026 |

These dates are estimates based on past IRS patterns. The exact date can vary if your return includes special circumstances, additional reviews, or errors.

Factors That Can Delay Your Refund

Even though most refunds are processed quickly, several issues can cause delays. Common reasons include:

- Filing Errors: Mistakes in income reporting, dependents, or Social Security numbers can delay processing.

- Incomplete Information: Missing signatures or forms will cause the IRS to hold your return.

- Verification Checks: Returns with refundable credits often face extra verification to prevent fraudulent claims.

- Paper Returns: Filing by mail can add several weeks to processing time compared to e-filing.

- Bank Issues: Incorrect direct deposit details or bank holds can delay funds reaching your account.

How to Track Your Tax Refund

The IRS provides two reliable tools to check your refund status:

- “Where’s My Refund?” tool on the IRS website.

- IRS2Go mobile app, available for Android and iOS users.

You can start tracking your refund 24 hours after e-filing or four weeks after mailing a paper return. The tool updates once daily, usually overnight, showing three stages: “Return Received,” “Refund Approved,” and “Refund Sent.”

Tips to Get Your Refund Faster

- File Electronically: E-filing is the fastest and most accurate way to submit your tax return.

- Choose Direct Deposit: The IRS recommends direct deposit to receive your refund quickly and securely.

- Double-Check Your Details: Review your return before submitting it to avoid avoidable delays.

- File Early: Submitting early in the tax season reduces the risk of identity theft and processing backlogs.

- Use Certified Software or Professionals: Reliable tax software or a licensed tax preparer helps prevent costly mistakes.

Special Notes for EITC and ACTC Claimants

If you claimed the Earned Income Tax Credit or Additional Child Tax Credit, expect your refund to be available by late February 2026 at the earliest. The PATH Act requires the IRS to hold these refunds until mid-February each year to verify income and eligibility.

What to Expect This Year

For 2026, the IRS has upgraded its processing systems to improve accuracy and reduce delays. Many taxpayers who e-file and opt for direct deposit could see faster results compared to prior years.

Still, the IRS encourages everyone to avoid calling their offices for updates unless it’s been more than 21 days since e-filing or six weeks since mailing a paper return.

Final Thoughts

Understanding the IRS refund schedule can help you plan your finances with confidence. Filing early, checking your information, and opting for direct deposit remain the best strategies for receiving your refund promptly. While most refunds are issued within three weeks, always allow some flexibility in case of verification or technical delays.

✨ You May Also Like ✨

IRS Today Announced $2,000 Direct Deposit for All – February 2026 New Payment Schedule & Eligibility Guide

IRS Today Announced $2,000 Direct Deposit for All – February 2026 New Payment Schedule & Eligibility Guide Social Security Payment Update: Millions May Qualify in 2026

Social Security Payment Update: Millions May Qualify in 2026 IRS Confirms Deposits! How Tariff Dividends and Refunds Will Be Processed | 2026 Stimulus Payment Guide

IRS Confirms Deposits! How Tariff Dividends and Refunds Will Be Processed | 2026 Stimulus Payment Guide Social Security 2026 new monthly payment figures : Social Security payment boost for 2026 confirmed

Social Security 2026 new monthly payment figures : Social Security payment boost for 2026 confirmed IRS Tax Refund Schedule Explained : When You Can Expect Your Refund Payment

IRS Tax Refund Schedule Explained : When You Can Expect Your Refund Payment